Cybersecurity and Data Privacy Roadshows - Bismarck

Event Details

ICBND is excited to partner with American Security & Privacy to offer Cybersecurity and Data Privacy Roadshows in Bismarck and Fargo! These sessions will be offered on July 14, 2025 at the ICBND Office, in Bismarck, and July 15, 2025 at the Bell Bank Tower, in Fargo. Agendas for each roadshow are provided below, along with a schedule and pricing. The cybersecurity portion will be held each morning, while the privacy section handled in the afternoon. Please select which sessions and days you'd prefer to attend when registering. An optional working lunch discussing FFIEC Cybersecurity Assessment (CAT) replacement will be facilitated by Dr. Streff on both days as well.

Register here!

Schedule for Roadshows (Same Schedule at Both Locations)

| 8:00 am - 12 pm | Cybersecurity Roadshow |

| 12:10 pm - 12:50 pm | Lunch & Optional Discussion |

| 1:00 pm - 4:00 pm | Privacy Roadshow |

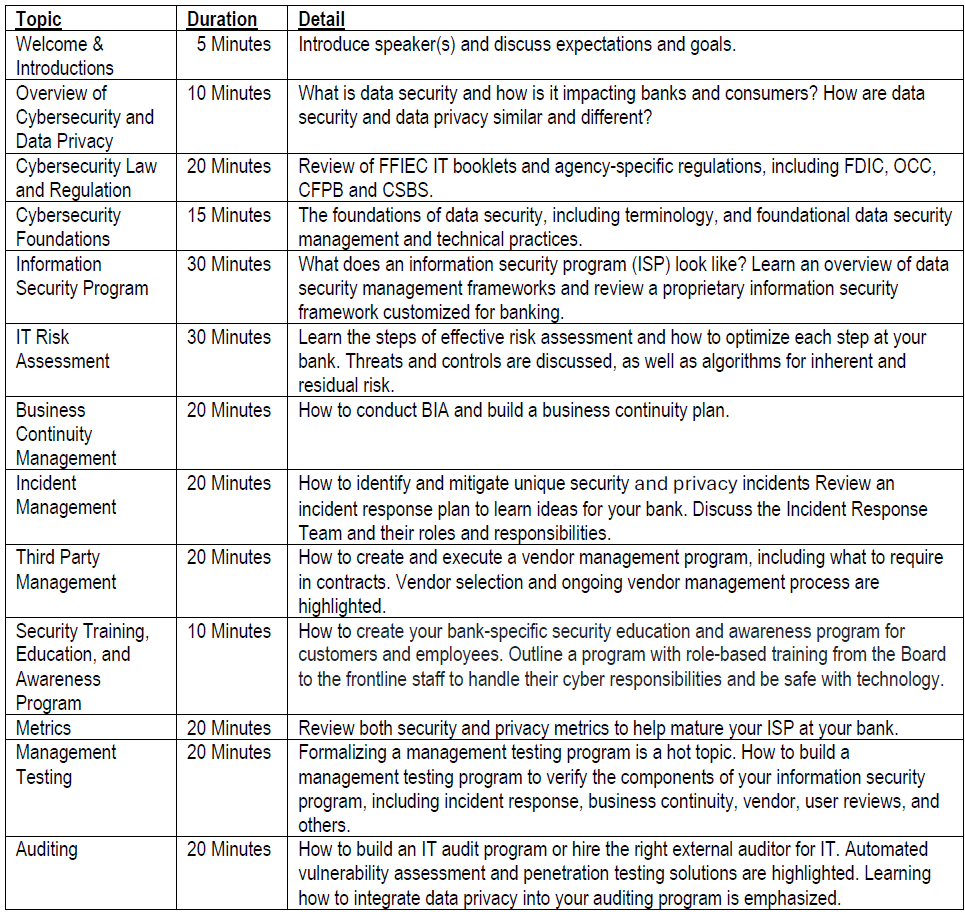

Cybersecurity Roadshow Overview

Cybersecurity remains a hot topic in banking and passing your next IT exam is getting more difficult with expanding requirements. Join this half-day cyber program to re-emphasize the foundations of an Information Security Program customized for banking that leads to a successful IT exam. Highlighted are the new additions in 2025 that banks must consider to keep pace with hackers and to meet increasing regulatory scrutiny. New technologies and integration into your Information Security Program, Risk Management Program, and Third Party Management Program are emphasized. Hot topics of data privacy, management testing, and comprehensive bank training are highlighted. Opportunities to network with your peers and learn from each other are provided.

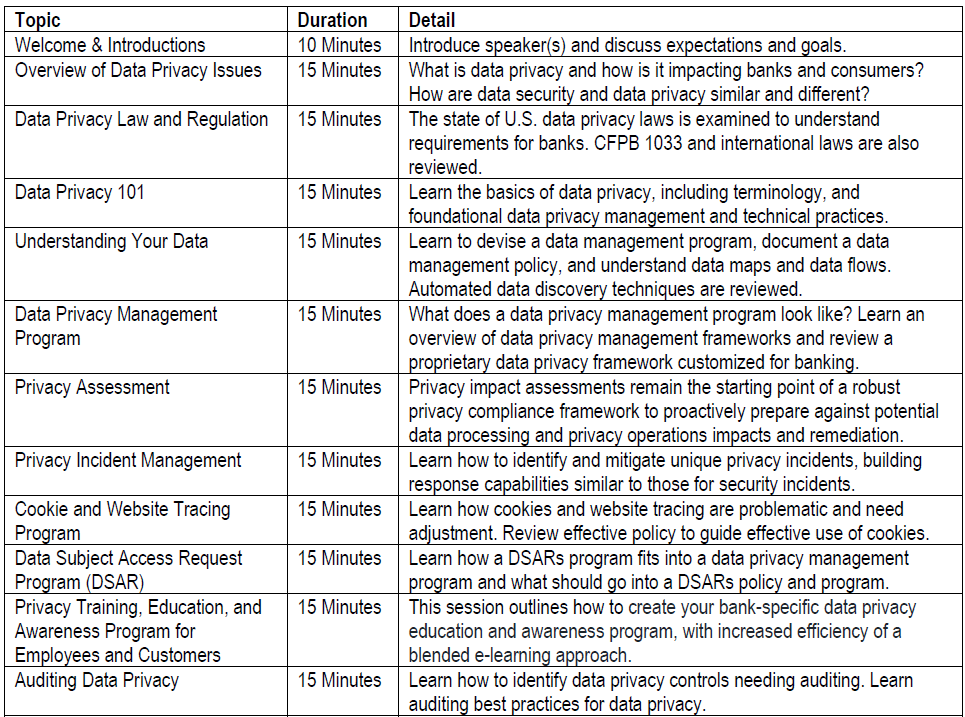

Data Privacy Roadshow Overview

Do you work at a financial institution and not understand data privacy? There are a variety of reasons requiring your financial institution to implement an Information Privacy Program (IPP), including international and state privacy laws providing consumers control over their financial data. Further, the Open Banking Initiative and the Consumer Financial Protection Bureau 1033 Ruleset requires financial institutions to provide consumer visibility and control of their data beyond privacy notices and opt out procedures. Lastly, with CFPB 1033, financial institutions are required to provide the consumer’s data to authorized third parties at the consumer request. How is your financial institution going to carry this out? All of this points to the need for all financial institutions to develop and implement a top-down, well managed IPP. Overnight this became a responsibility of the bank. Are you ready to develop and implement an IPP for your financial institution?

For More Information:

1136 West Divide Avenue P.O. Box 6128

1136 West Divide Avenue P.O. Box 6128Bismarck, North Dakota 58501

United States 701.258.7121

Price:

Cybersecurity Road Show (AM Session) - $XXX per person

Data Privacy Road Show (PM Session) - $XXX per person

BUNDLE Cyber Security & Data Privacy Road Shows (AM & PM Sessions)- $XXX per person

Instructor: Dr. Kevin Streff - Founder and Managing Partner

Dr. Kevin Streff - Founder and Managing Partner

Dr. Kevin Streff is Founder of several cyber startups and acquisitions, including American Security and Privacy, LLC, Secure Banking Solutions, LLC, SBS Cybersecurity, LLC, and Blu3 Technologies, LLC. His businesses have worked across all fifty states and internationally helping organizations comply with legal and regulatory data protection mandates in the banking sector, as well as planning and implementing sound information security and privacy strategies.