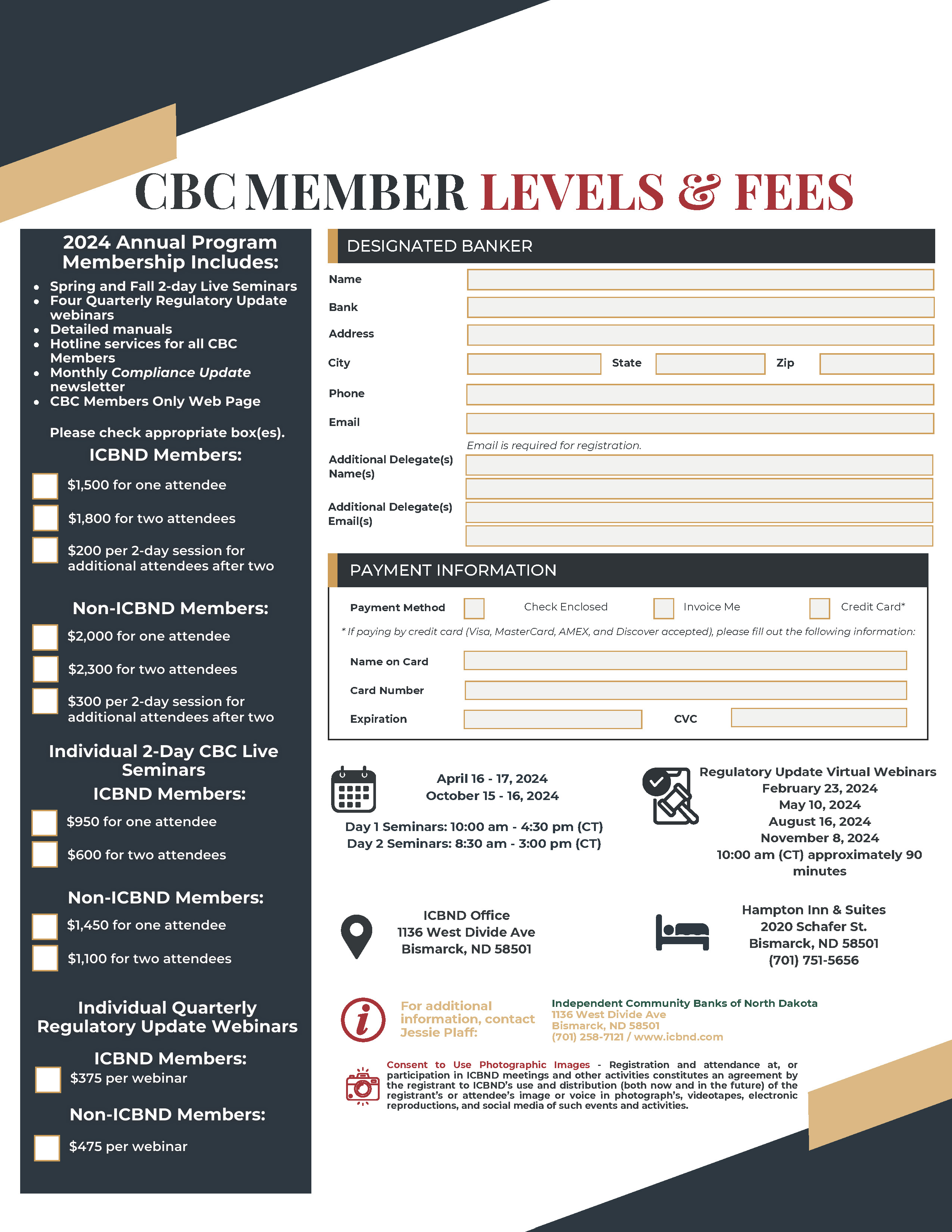

- 2024 Annual CBC Program

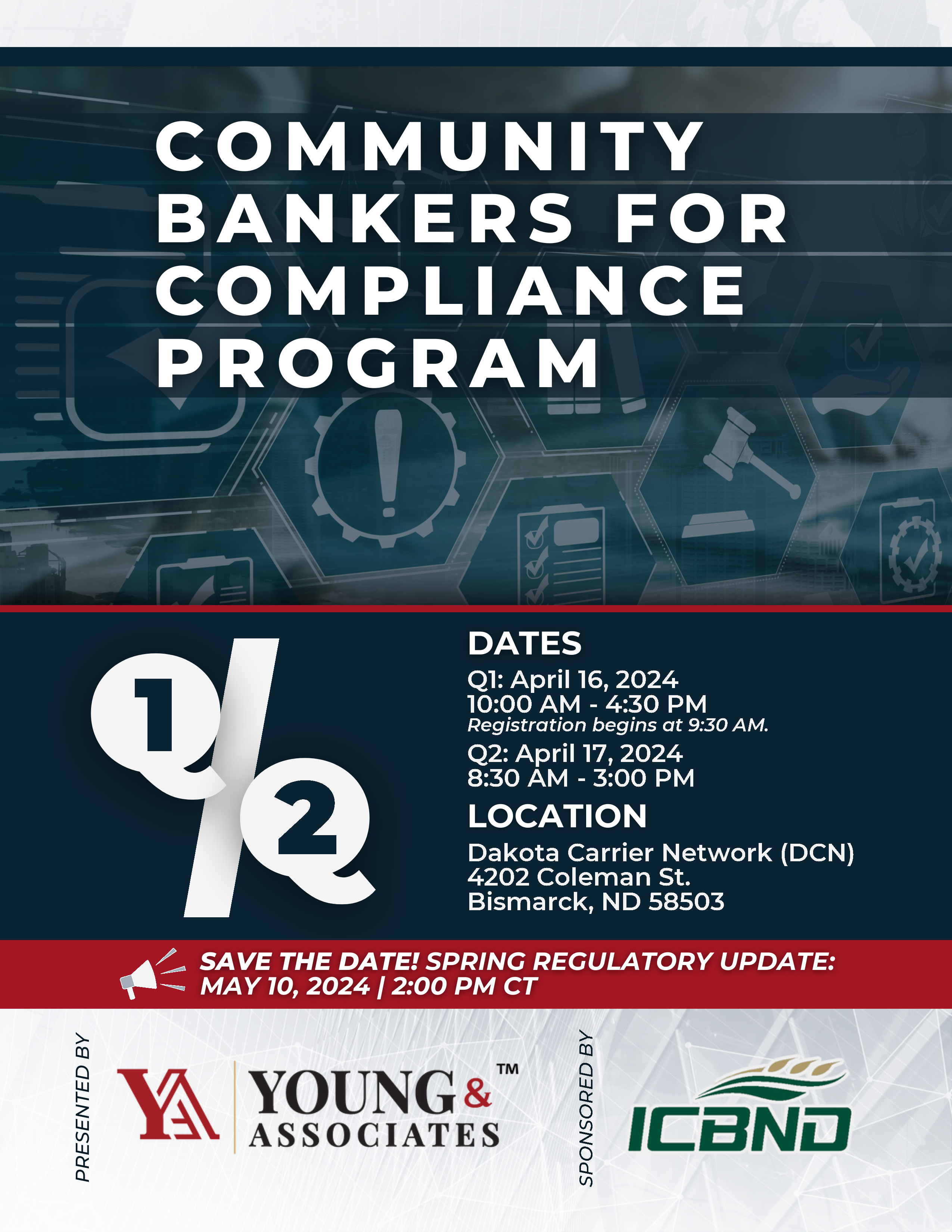

- April 16-17 Spring CBC Session

- October 15-16 Fall CBC Session

- Regulatory Updates

Regulatory Updates

Join a vibrant community of industry leaders in a fun and engaging environment and create authentic connections with professionals who are just like you.

Rethink the status quo and expand what you know about leadership, technology, and the vital role of community banks as the life blood of local communities across the nation at the LEAD FWD Summit.

Quarterly Regulatory Update Webinars:

February 23, 2024 - Event Brochure

May 10, 2024 - Event Brochure

August 16, 2024

November 8, 2024