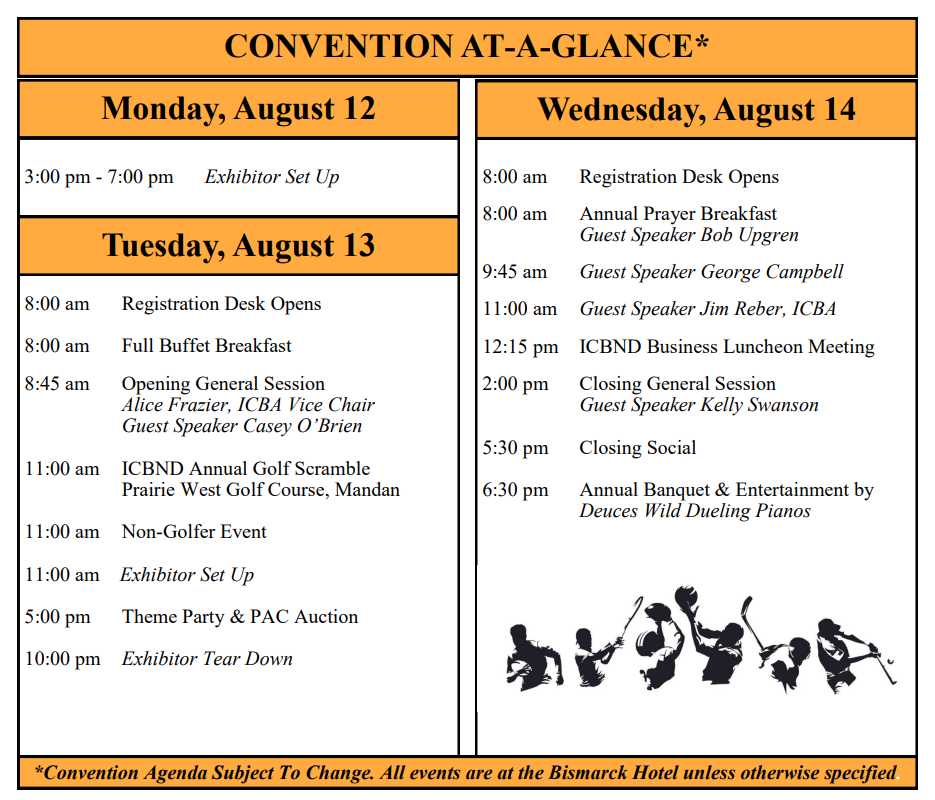

- Schedule At-A-Glance

- Golf Scramble

- Speakers

- Sponsors

- Exhibitor Info

- PAC Contributions

- Registration Forms

- Service Award Nomination Form

- Accommodations

Golf Scramble

Golf Scramble Registration - Please complete and return this form to register for the ICBND Golf Scramble

Registration Forms

Exhibitor Registration

Special Olympics North Dakota Donation

Banker/Non-Exhibitor

Information

Banker/NonExhibitor Registration

COMING SOON

ICBankPACICBND PAC Raffle Fundraising Form

|

Consent for Use of Photographic Images – Registration and attendance at, or participation in, ICBND meetings and other activities constitutes an agreement by the registrant to ICBND’s use and distribution (both now and in the future) of the registrant’s or attendee’s image or voice in social media, photographs, videotapes, electronic reproductions, and audiotapes of such events and activities.

Service Award Nomination Form

As we will soon be celebrating the 56th Annual Convention of ICBND, please help us recognize the dedication of men and women who have given so much of their lives to the integrity of independent community banking by nominating them for the “ICBND Service Award.” We will honor only those individuals who have reached a “milestone” year, i.e. 20, 30, 40, 50 and above within the year of 2024. No award will be given for the years in between unless they are retiring this year and have over 20 years of service.

These awards will be presented at the 2024 ICBND Annual Convention, during the closing annual banquet, on Wednesday, August 14, at the Bismarck Hotel and Conference Center. The honoree will receive a personal invitation as our guest for this event. For those unable to attend, we will deliver the certificate to the bank president for personal presentation to the honoree.

To nominate someone for an ICBND Service Award, please complete and return the ICBND Service Award Application.